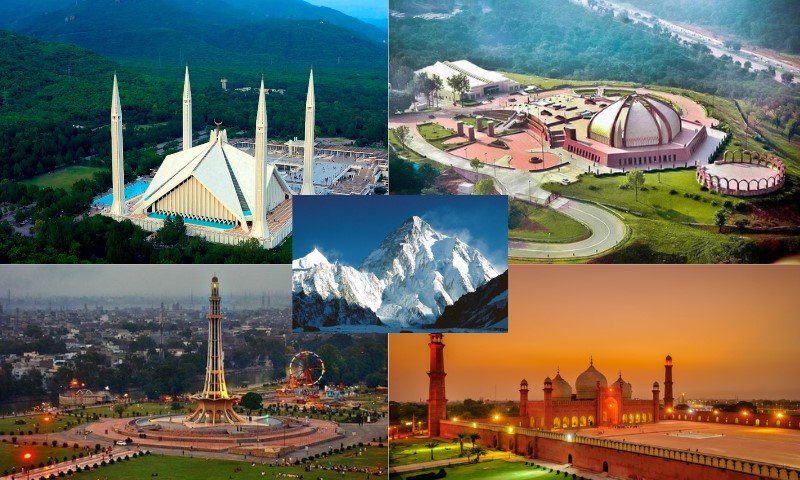

Pakistan is preparing to repay roughly $1.3 billion in April 2026 on a maturing international Eurobond, covering both principal and interest, amid efforts to meet its Net International Reserves targets under the International Monetary Fund (IMF) program.

The repayment precedes an IMF review mission scheduled later this month under the country’s $7 billion Extended Fund Facility. The delegation is expected to start in Karachi before holding key talks in Islamabad around March 2, focusing on fiscal reforms, external financing requirements, and progress on structural benchmarks.

To bolster external buffers, the Ministry of Finance plans a Panda bond issuance in Chinese capital markets, aiming to raise an initial $250 million tranche shortly after China’s holiday period. Officials noted strong investor interest, with the offering potentially oversubscribed.

In a bid to demonstrate repayment capacity, Pakistan has already repaid a $700 million Chinese commercial loan ahead of schedule, with Chinese banks expected to refinance the facility within the current fiscal year. Simultaneously, Islamabad is negotiating with international commercial banks to secure an additional $500 million in fresh financing during the ongoing fiscal cycle to stabilize external accounts and sustain momentum under the IMF-backed reform program.