The International Monetary Fund (IMF) has urged Pakistan to simplify its tax system ahead of the fiscal year 2026-27 budget, according to official documents cited by ARY News. The Fund has recommended that the reforms be implemented by May 2026, focusing on reducing tax exemptions across various sectors, lowering special regimes, and minimizing heavy withholding and advance taxes.

The IMF also advised limiting the Federal Board of Revenue’s (FBR) authority to create its own rules and suggested the issuance of an annual report tracking the FBR’s progress in implementing these recommendations. Improvements in the organizational structure of the FBR, reducing the powers of field offices, and enhancing accountability in operations were also highlighted. Additionally, audit findings related to payroll are expected to be issued within one year.

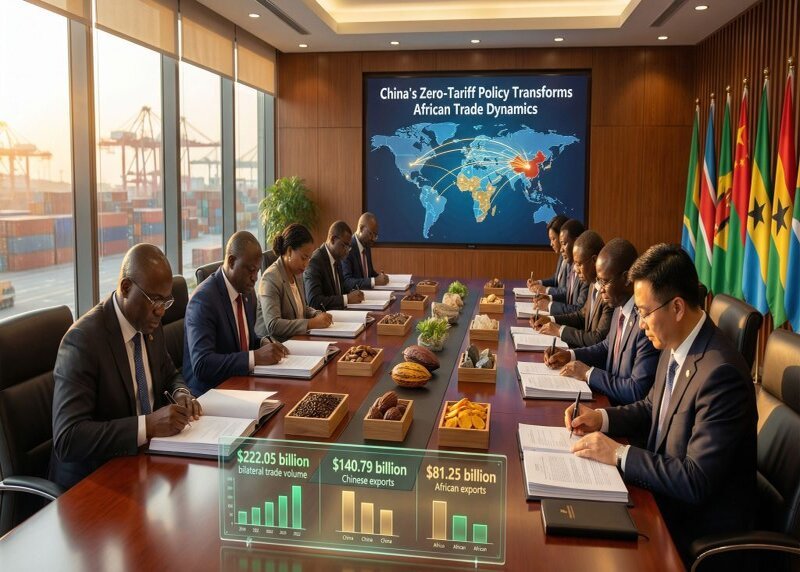

Separately, the IMF Executive Board is scheduled to meet, with Pakistan anticipating approval of approximately $1.2 billion. The board will review the staff-level agreement recently reached with Islamabad, potentially authorizing a $1 billion tranche under the current loan programme. Furthermore, Pakistan could receive the first $200 million instalment from the Resilience and Sustainability Facility (RSF), aimed at supporting climate-related initiatives. Final disbursement will depend on the board’s deliberations during the meeting.